The Central Bank of Nigeria’s (CBN) announcement on 26 Oct 2022 should have been momentous in Nigeria; The CBN Governor announced that the N1000, N500 and N200 notes would be redesigned and reissued within a ninety day window.

Cash was about to be killed.

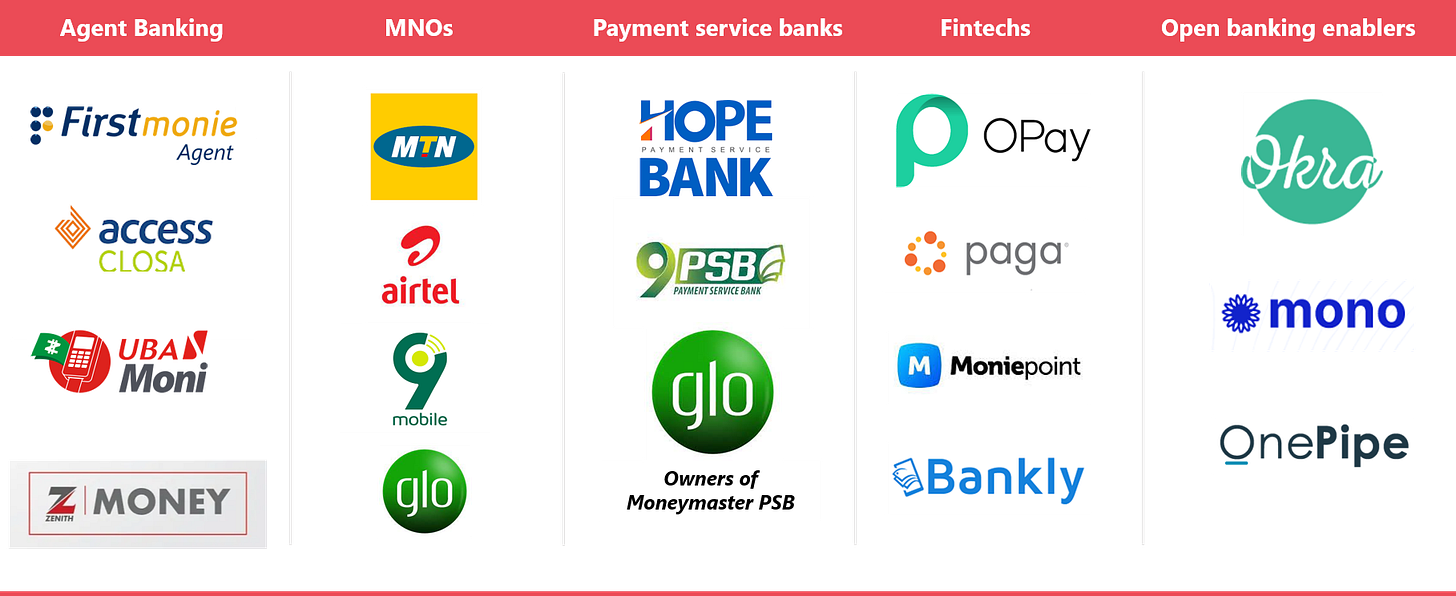

I exaggerate but perhaps not too much. The Central Bank had been promoting financial inclusion for some time and announced several key initiatives. They had already brought down the cost of transfers of electronic money through NIP (NiBSS Instant Payment) then they facilitated access to financial services through SANEF , an initiative in collaboration between licensed agents, commercial banks and mobile money operators. CBN also put money where its mouth was with low interest loans of up to N500mm for eligible SANEF members. The recent granting of licenses to Payment Service Banks, and particularly to MTN with the largest agency network in the country was proof that the CBN meant business.

But the 26th October announcement was a big move in digitising the bulk of cash in circulation so that after the 90 day window, there would be traceability of the bulk of currency in circulation.

Was this the beginning of the end of Cash?

Was this a crucible moment that would spawn a few players taking advantage of the moment like Paytm in a similar moment in India. Agents maybe?

Would we see digital banks begin to soar like the some of the new generation banks (of FUGAZ three: Access, Guaranty, Zenith were all the original fintechs?

Would MTN’s MOMO fresh with a license and over 180k agents laugh its way to national dominance.

What about the digital banks? Is this when they make their move?

There’s almost a Game of Thrones feel to the situation and the excitement is palpable. Let’s all calm down and set the scene first.

Killing the (false) King

First some numbers. From the CBN, currency in circulation as at August 2022 was N3.21trillion, with funds outside banks at 2.68trillion. CBN’s currency report of 2020 states that higher top 3 notes affected by the CBN policy make up are 43% of volume but 93% of value. But basically in terms of volume, more than half of the notes in circulation would not be affected and these notes (with the exception of N200) make up the bulk that are used for low-cost transactions

Bismarck Rewane at a recent seminar said that there are three main uses of cash:

Speculation; if I hold cash I make money or in today’s case if I hold N10k, i may be able to sell for N12k electronic money

Transactions I want to buy goods in the market

Cautionary : I don’t know what is going to happen so let me hold this cash that everyone always takes.

Just like we were all hoarding toilet paper during Covid, I suspect there is a fair amount of demand that is cautionary and this is not an uncommon view;

There is also a fair amount that is speculative but this is difficult to quantify.

What is clear though is that there is a demand for a solution to allow willing buyers and sellers complete transactions.

The Opportunity

A week ago I argued in another essay that African entrepreneurs have to solve real problems. Payments is one of those but in Nigeria we have not yet solved the problem of the last mile where you have a willing buyer and seller but the medium of exchange is not available. If this were early last year, some tech-bro would chime in here with: “Bitcoin solves for this”. Thank God they are all counting looking at prices of their shitcoins so I can just continue 😀

At the same seminar Bismarck Rewane shared an anecdote around the challenges of digital payments in everyday activities.

"someone asked a market seller if they accepted digital naira. The trader said if its digital egusi you want yes, otherwise bring physical naira”.

Nigeria has a large informal economy with cash being used to pay for public transport, repair tires, shop in the open air market. Many of these participants may have bank accounts but currently, the job to be done of making or receiving payment, safely and securely is done by cash.

This is an opportunity because we know it has been done in other markets; Mobile Money in Kenya and increasingly Ghana are the obvious markets to copy. Its not often you see Nigerian entrepreneurs asking for help from our African brethren but today is the day. So Nana and Njeri, forgive Ngozi and all Nigerian entrepreneurs who have been condescending for years and give us the magic.

So what do should do ?

Customers have long memories

I am not sure but I have a sense of what NOT to do.

Warren Buffett and Charlie Munger are big proponents of inversion; the concept that to understand how to reach a destination or goal, focus on the ways not to get there. For example, I want to engender trust amongst my customers. I am not sure what to do but inversion guides me to think of what I should NOT do. For example things I should not do include:

charging customers very high fees for a commodity product in times of crisis

restricting or avoiding communication with customers or

expose them to harsh conditions whilst trying to receive a service from me

Ok, you are writing too much. Abeg who are winners & losers?

Agent Networks - Score Draw

Agent networks have expanded significantly through private capital and some funds from the Central Bank. Whilst ATMs across the country are at approximately 20,000, ‘Human ATMs’ (many tied to particular networks) have grown exponentially. It is hard to put a number of unique agents because there can be significant overlap between different networks (one agent to many networks) and many of the networks are fond of being enthusiastic with their real numbers but estimates put this number at around 1.5mm nationally. That’s a lot of bodies so I am open to correction.

However, these agent networks are increasingly providing access as key partner of the formal banking system. They will play a key role in any broad solution in providing access to cash. However many of the networks leave a lot of discretion on pricing to the individual agent.

So If I am in a rural area with no competition, I can charge N500 if you want to cash out N1000. This may make for high short term profits for the agent but may leave lasting damage. I suspect that most customers see this price gouging (or ‘surge pricing’) as driven by the individual agents and not the networks they partner with.

What is not clear is if the accumulation of surge pricing premiums are greater for the agent despite the expected decrease in transactions. But given that most agency networks charge a fixed fee, then perhaps the likes of Opay, Moniepoint etc are actually losing out.

If you know please shout.

Digital banks - neutral

I do not get the sense that local fintechs are gleefully cleaning up house; I certainly haven’t heard of anyone buying a 2nd Range Rover.

It may well be that the biggest benefit from this exercise for fintechs is not a boon in customer acquisition but the increased loss of trust in their banks. At Carbon we don’t see other fintechs as competition (they too don’t have money 🤣🤣🤣) but rather the commercial banks). Customers hate the way their banks treat them but they trust them as evidenced by the fact that they keep the bulk of their funds there.

But this belief is on the assumption that “If I need my money, i know where to get it. I can go to their ATM of 300-odd branches”. The cash shortage is chipping away at that trust and has been exacerbated by reports of bank infrastructure straining under the spike in electronic transfers.

But from the digital bank it doesn’t seem like there is a Paytm waiting in the wings. Is it early days? Will customers cross the chasm into our waiting arms? I think its early days but for those whose business model will accelerate with increasing digitisation, this could be a crucible moment?

The Commercial Banks - Negative

The banks may say that its not their fault there is no cash. But the customers will still hold them responsible for how they are treated at their ATMs or branches. Is there an orderly process by bank staff? Are bank employees rude or courteous. There is no upside for the bank in all honesty; when you go to an ATM you don’t applaud the bank if the money comes out. Similarly the best the banks can do is minimise damage. Let’s assume that the number of ATMs nationally is approximately 20k. If we assume the top 5 banks have 75% of them, then for each there are 300 ATM locations daily where their staff are going to have to be on their best behaviour in customer service in very trying circumstances.

But it gets worse - Several banks have configured their ATMs so that if you use their debit card, you can get up to N20k. If you use the debit card of another bank, you may be limited to 5k per withdrawal so if I want to get N20k have to withdraw 4 times. I have three free withdrawals and then I have to pay N35 for the last one.

Nigerian banks are too much. Man I understand the sentiment but I can’t imagine a way to piss of future customers; I’d also spend any time I had not to configure my system to get that N35 and reminding them about how a bank makes a lot of his money from NOT lending to its retail depositors but charging numerous fees. I would spend any dev time on making sure my systems were resilient instead.

But hey, don’t work in a commercial bank so what do I know.

So what next? My prognosis of the future is as follows:

Platforms that have resilient platforms will benefit. There can be as many as 9 different parties in a card payment, each one a point of failure. Solutions that minimize the dependencies will gain trust. So if you control rails between 2 parties you win. I believe GTCo is working in this direction but I suspect others too

Customer trust has been shaken and this is a time when they may be open to new ideas. All players should not estimate the long-term impact of this; the result may be less tolerance for high fees or failed payments. Brands that project and deliver on reliability will win

Its time to build innovative solutions that engender trust and reliability. Cash has a place but it shouldn’t be this dominance given the examples of mobile money we see from China, Kenya and more recently Ghana. But there is no escaping the hard work and costs in building networks and managing a 2 sided marketplace.

Its not winner takes all whilst Mpesa is telco driven with recent collaborations with banks, Alipay from the start was in tandem with Chinese banks. Same outcome, different journeys. That’s what makes this crucible moment so exciting.

Let’s be clear - the commercial banks are not sleeping and are (not so) quietly building up competency in agency banking, neobanking etc. Wema and Providus power a significant number of fintechs via virtual accounts or payment APIs.

All parties now have a better sense of the importance of cash - the linkages from urban to rural areas. And the main players have access to capital, licenses and significant distribution. Whatever cashless solution that comes up will not be accidental but come either from a unique and differentiated strategy backed by capital or from the patient and deliberate collaboration between multiple parties.

Will the throne be taken? Or must it be shared.

For now grab your 🍿🍿, the film has just started

Thanks to Osheyi Ogunbanwo for the payments primer - I still don’t understand (and any misunderstanding is mine not his) payments but you tried sha.

This is so powerful. I truly enjoyed how you used inversion principle to explain what’s happening in our dear country currently. Please I sent you a DM on tweeter please check

Did you write that part about Carbon or they did?