“There are three kinds of lies: Lies, Damned Lies, and Vanity Metrics”- Mark Twain was reputed to say 😀. You got me, he didn’t but every good article needs a quote from a historic great. But to set the table, I saw a nice definition of vanity metrics in the context of startups:

Vanity metrics are metrics that make you look good to others but do not help you understand your own performance in a way that informs future strategies.

Community-adjusted ebitda, downloads, gross merchandise value, customer app downloads, customer signups; these are all vanity metrics. In startup land, founders have swapped key performance metrics for vanity metrics and the beauty is that you are only limited by your creativity.

These metrics are detribalized equal opportunity numbers; good for liberals, woke and conservative founders and can be seen as early pre-seed decks and even make strong appearances many years later in Series B pitches. Furthermore they are loved by founders and investor alike, the latter particularly when they feel good about a company/founder but searching for a solid justification. My favourite example is Jumia’s definition of active customers from their IPO period:

Active Consumers means unique consumers who placed an order on our marketplace within the 12-month period preceding the relevant date, irrespective of cancellations or returns.

So if you heard Jumia say that they had 4mm active customers at IPO, it is possible that 2mm may have cancelled or returned their order 364 days ago but they are still being used for marketing purposes. The golden rule for consumers of vanity metrics is “anything that happens to you after, just take it like that”

But it gets worse 💩💩💩💩💩

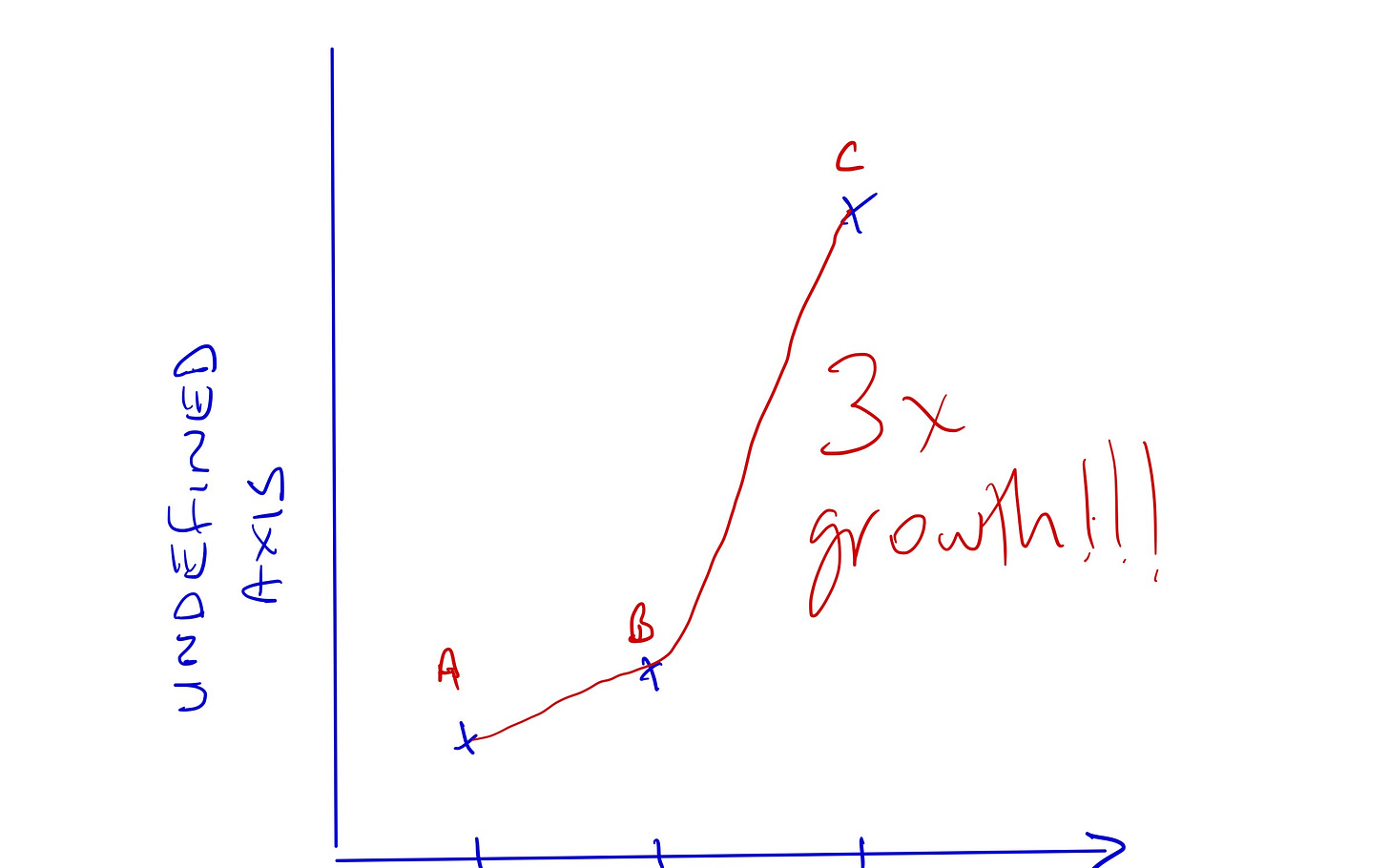

There is only one thing worse than a vanity metric; a vanity metric in a chart with one or two axes missing any proper measurements. An example:

This is an example of drivel that is shared too often. If you are lucky, a founder will tell you that A, B and C are the first three months of the year and look, we did 3x growth in customer between February and March 2022. Wow that is amazing bro - please can I invest? What they may not tell you is that point B may be 2 customers and point C, 6 customers. Not so impressive now right? And we haven’t even talked about whether the customers were actually transacting or if they churned immediately.

But this chart may draw oohs & aaahs from the Twitteratti and maybe even an investor or two.

Finding religion

Before I get stoned for hypocrisy, let me confess that I too have engaged in the dark arts of bullshit vanity metrics. I can’t remember whether I felt dirty about it but with time, I have found religion and hope to convert many to our one and true god (please its lower case G I used before the religious try and stone me). And this true god is GAAP or Generally Accepted Accounting Principles. What tends to be common about vanity metrics is that they are never part of any generally accepted accounting principles. In fact, if its a vanity metric, by definition it will not conform to GAAP.

But at some point in Easter 2018, my Carbon co-founder and I had a transformational experience and decided to renew our baptismal promise; We vowed to “reject sin, the glamour of evil, and refused to be mastered by vanity metrics”.

But not many founders worldwide have decided to the walk the straight and narrow path so we should try and understand the root of the problem.

Why do founders engage in the sharing of these vanity metrics? Do they help?

A few thoughts come to mind:

Virtue signalling - it feels good to be seen as successful

They are fundraising and trying to advertise growth/strength

Things are really bad so you pull out a metric that might deceive people and get you that term sheet

Pride - you have just started the company and are pleased with the ‘traction’ you have seen

One reason that I would have some sympathy for is the use of vanity metrics just to increase the founders’ confidence. Entrepreneurship is rough and God knows that founders need some self-love. When things are going bad I would never blame a founder for putting out a puff piece that they think can help in recruiting employees, attracting investors or even just making themselves feel good.

Surely if year after year a startup rises spouting these metrics, and gets wonderful investors, there must be some benefit. Right?

Bleaching

First of all; MJ, King of Pop - please forgive your loyal servant for using these photos of you to make a point. I am sorry.

In Nigeria and this exists the world over, many men and women will bleach their skin or if I am being kind, perform skin lightening procedures. Bleaching, has terrible side effects on skin that are well publicised and yet year after year millions continue the practice.

Why? Because it works. People believe they are more attractive and will get greater attention from admirers if they are of a lighter hue. And presumably there must be some truth in the correlation between attractiveness and skin-lightness otherwise this practice would fade to black (get it, fade to black? I am contrasting the bleaching with… never mind)

At this point, I am tempted to tell you that I am one of those “the blacker the berry the sweeter the juice” kind of guys but we don’t really know ourselves that well and besides, this is mean to be a business newsletter. Ngozi focus!

Vanity metrics are the bleaching of the startup ecosystem. Founders feel better about themselves even if fixation on those metrics add no value to their ability to manage their company. And if there is anything we know from the excesses of the last decade, its that many investors have been happy to support thousands of companies with no more than vanity metrics to support their investment thesis.

Seeking the Truth

The ultimate goal of most companies is to be self-sufficient, able to operate with just their internally generated revenue. Many will say that stock markets are where you can get a true valuation of a company. Why? Because there is very quick price discovery; due to much higher liquidity of buyers and sellers, there is a much quicker reversion to true value. Also if investors believe that a stock is overvalued, the stock can be shorted.

And how do these listed entities convey the strength of their companies; do you see Jamie Dimon tweet pictures of some crazy growth with only one defined axis? Or even Amazon drone on about their Gross Merchant Value in isolation? No you don’t. The one common language used by these listed companies are metrics that confrom to Generally Accepted Accounting Principles.

Vanity metrics don’t help startups grow. Its like babies sucking a dummy - it feels good, makes you happy but its not going to help you grow in the long run. And the longer you focus on vanity metrics, it becomes a habit and delays the inevitable focus on real metrics.

So the next time you see founders touting vanity metrics, please hail them well and clap loudly. They might need a hug. But then slide into their DMs and tell them you will love them and encourage them to embrace GAAP. Everyone wins.

Random note: Thanks again for reading, I have been writing in a haphazard manner but from next week I will try and be more disciplined and publish articles on the 2nd and 4th Mondays of the month

I like how you have broken down Vanity Metrics Ngozi. I am working on an article where I will refer to these metrics and I am glad to have discovered your newsletter.