Pre-2016 if you had asked any founder what their biggest obstacle was, they would most likely have cited a lack of funding. Things changed with zero-cost capital, Y Combinator’s innovation in funding entrepreneurs, and the growth of an angel investing community buoyed on by lucrative exits to larger funds. Founders have never had it so good. I argued in my last essay, “The beautiful ones are not yet born”, that the reason we have seen minimal returns from the significant capital investments in African startups was the focus on the wrong type of startups. I posited that the majority of capital has been directed toward startups pursuing efficiency-creating innovation (good), instead of market-creating innovation (excellent) that drives growth in productivity, jobs, and economic prosperity.

I never miss a chance to hate on venture capitalists (VCs) who have never seen it fit to fund my lifestyle invest in Carbon, the love of my life, so would love to drop all the blame on them. Unfortunately, founders play a pivotal role in all of this. While venture capitalists may have investment strategies that dictate the type and structure of their deals, they can only invest in what founders put in front of them. For now the current incentive structures all but guarantee that market-creating innovation will be a rare exception amongst the ideas that come to market. The TLDR of this article is that for us to progress, we need:

capital to be scarce again - it’s a feature, not a bug.

flexible & discerning investors with patient capital; long-term greed is good.

a new set of founders particularly rich & boring accountants & lawyers. Seriously.

Setting the scene

First of all, let us agree that the entrepreneurial path is meant to be difficult. If your typical professional (e.g. lawyer/ banker) role is analogous to a walk in the park, then starting a company should be an obstacle course. When Nneka tells her parents she is going to leave her sterling legal career and start a company, you’d expect them to try and dissuade her and rage that they didn’t fund her Master’s degree for her to become ‘unemployed’. In extreme cases, they may even call Pastor Paul for special prayers to drive out the demon that has taken root in Nneka, who always obeyed her parents till she began reading about this YC cult in faraway California. 90% of the Nnekas will fail, beg their parents for forgiveness (it was a terrible possession after all), and go back in shame to their law firm, now 2 years behind their peers.

Yet, this narrative of entrepreneurial struggle has changed recently, thanks to three key players: an influx of capital, less discerning VCs, and entrepreneurs venturing for personal gain, all collectively altering the startup ecosystem's landscape.

A shit load of capital has poured into the ecosystem

Over the last decade, it's been easier for VCs to raise capital because of low interest rates. They are incentivized to manage larger funds since their fees are a fixed percentage of assets under management. With more money to manage, they have been keen to invest in a wide range of companies. As opportunities saturated in the West and even other emerging markets, Africa Rising and other catchy slogans presented a great opportunity to deploy more capital.

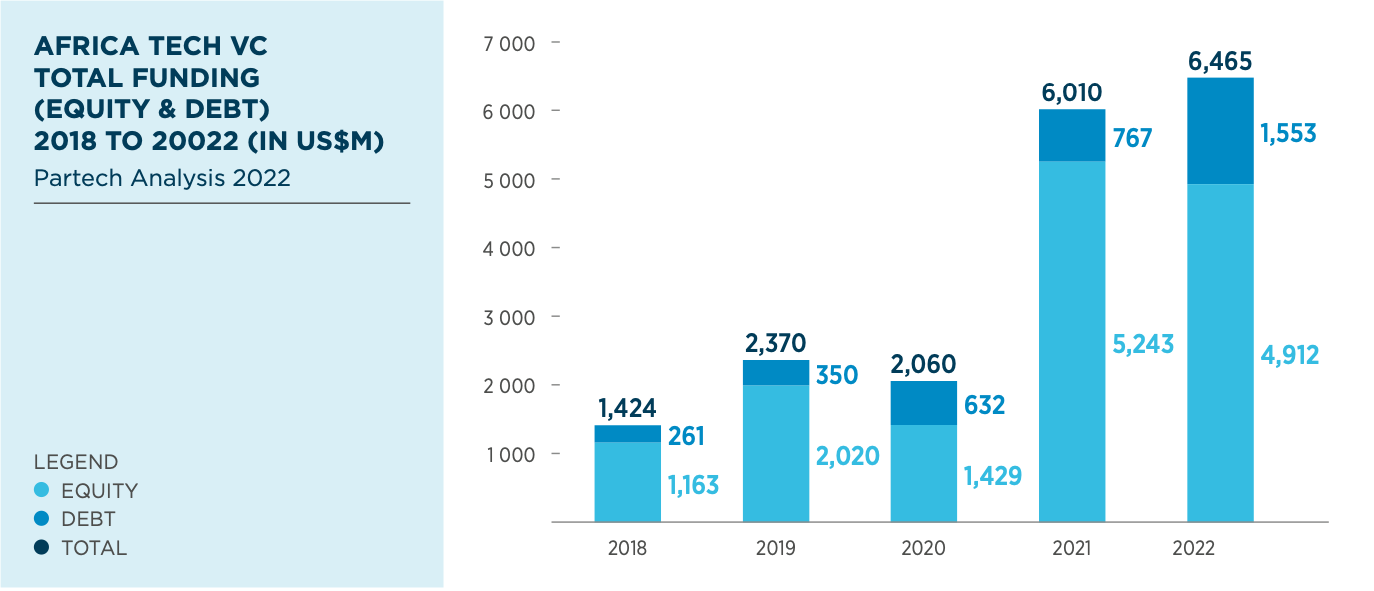

Not surprisingly, there was a 4.5x growth in African funding between 2018 and 2022 - that’s a lot of wonga looking for a home. It’s analogous to a kid going to buy sweets in a candy store with their mummy’s American Express card. “Oh wow, those look like Snickers but the African version. I bet they taste really yummy too!”

That’s been the nature of VC investments over the last 5-10 years. With excess liquidity these investors have extended their generosity far and wide, inevitably betting on ventures that were probably too early to absorb so much capital. If you need proof, look up the story of Dash & of course Jumia. Like the inscription on Sir Christopher Wren’s tomb says “Si monumentum requiris circumspice”: if you want to see the legacy of this capital glut, just look around you.

The tragedy is that market-creating innovation (MCI) needs larger capital investment to build new value chains and serve non-consumers. Instead, what we have seen are excessive investments to subsidize the current set of consumers (instead of non-consumers that MCI targets) and the trillion-dollar aspirations of Google & Facebook.

Entrepreneurs are hiring corruption

The Prosperity Paradox contends that people ‘hire corruption’ for any one of three reasons”: i) They want to progress in their lives ii) Their cost structure is much greater than their revenue iii) They want to subvert the existing laws to make progress if they can get away with it. The theory doesn’t say that corruption is good - rather it uses the Jobs to be Done framework to explain why it happens. In this case “improve my current life” is the JTBD the entrepreneur wants to achieve.

In the same vein, I think many founders today are “hiring entrepreneurship” to make progress in their lives. Unlike the West where most people are on a higher level of Maslow's hierarchy of needs, Africa is tough. With no formal social security net, even a well-paid job does not give you a sense of stability.

I promise you that for millions of Africans, the definition of outstanding progress is a dollar salary and the chance to live abroad. It doesn’t even have to be a good job - if it pays euros, dollars, sterling we are more than halfway there. Here is what hiring entrepreneurship looks like:

You want to leave your beautiful country. What better way than to get into an accelerator and be on track to get an entrepreneur visa to the US, Canada (or France if you didn’t fill out the application form well)

You earn Kenyan shillings today but even at $2,000 a month the majority of founders according to my scientific research, will earn more than their full-time job. Probably more than their boss

Lastly, entrepreneurship is meant to be a difficult path for committed founders with deep domain knowledge. But many have “subverted” the old laws using a slick deck, speaking quickly about 200mm customers and technobabble. Suddenly they find themselves with more cash than they ever thought possible.

As seen in society, corruption has a long tail pay-off; if said founder can burn the cash quickly and get some quick results, they will get more money leading to higher income, greater status, etc. You are not going to believe this but if they are lucky and ‘fail fast’ they will raise more money with a shorter deck as long as they stamp their deck with that higher chieftaincy title “Second Time Founder”. This doesn’t seem so hard; maybe Nneka should try again because she is missing out

VCs are no longer discerning

“Luckily” for founders, the excess of capital has meant that they haven't had to dig deep to solve hard problems

To meet the demand for startups, many founders have taken the path of least resistance to create companies. You see all these foreign investors coming into your market, serving cocktails and wonderful canapes at all these restaurants you can’t afford and they want to give money. Your choice is two-fold

Think deeply about big problems with the potential for large markets where your experience and skills give you an advantage, formulate a plan, and after diligent research pitch to investors at the next cocktail gathering

Read hacker news during your lunch break and the next day put together a slick presentation dec with the three magic phrase constructions

We are the X of Africa.

Nigeria is so big, and has 200 million people; there is no data to back this up but my mummy told me and like Pastor Paul, she never lies.

Draw a four-quadrant diagram with your startup in the top right corner and other incumbents or competitors in the other three corners.

VCs with more capital than investment sense love this. What many don’t know is that most VCs can’t answer the same questions they love to put to founders:

“How are you different from your competitors?

“How do you win dominate the market?

As an aside, next time you are pitching a VC, ask those questions forcefully; I promise you that nine out of ten will end up sleeping in a fetal position hugging their childhood teddy bear. The second is my favorite; because the world is binary right and if your company’s market share isn’t at least 80% then it has failed. “I wonder Mr. VC, What’s your fund’s market share, Mr.VC?”

Sorry, I am getting PTSD from some fundraising conversations.

The point is that these special VCs love(d) “X for Africa pitches”; it is like a warm soothing blanket that makes their job easier; But dear reader as you can imagine, when not so knowledgeable/committed founder meets not too discerning VC, its a far cry from Sequoia’s motto, “We help the daring build legendary companies”

What is to be done?

We need hard times

It is unlikely that many of those VCs that have invested in the last decade are coming back for more. There is no reason they would especially as exits are as rare as a P&L statement in a founder’s pitch deck. Persistent currency devaluation and worsening macroeconomic fundamentals in Africa mean there is extra work to be done by the startups to justify the investors’ risk. Add a dash of corruption (not by Nigerian princes) and anyone can float (get it, do you get it 🤣️️️️️️🤣️️️️️️ - I laugh in Ghanaian Jollof) the idea that it is not worth investing in African startups.

Starting a company and getting funded is going to become hard and you will need a really good idea to find capital to fund the business.

Wait a minute? Isn't this the way it is meant to be? This might just be the catalyst to ensure that more market-creating innovations are attempted. Not a bad result.

We need new types of capital (allocators)

It's time to bid adieu to the 'X for Africa' narrative and welcome investors willing to roll up their sleeves, understand the unique market dynamics, and back startups ready to build across value chains.

The VCs of the last 5-10 years invested in the Xs of Africa and it didn’t work for them. They will need a different playbook assuming they even come back. The standard 2& 20 10-year fund may be inadequate - more flexibility and patience will be required. We need a different type of funding for MCI; evergreen funds of investment holding companies of the Berkshire Hathaway type are better suited for this. Pension & Life Insurance funds, we love you.

We need a new set of founders

The age of funding the smart & interested founders is over. We need insiders; not just tech-savvy enthusiasts, but folks with gritty experience in industries crying for innovation. They could be lawyers, construction workers, or plant operators as long as they have a burning desire to solve real, nagging problems.

As an example, I have been looking for a problem to solve reconciliation issues at Carbon. In the last 2 months, I have engaged with several fintechs who claim to have a solution. To a person, all techies and no boring person versed in financial operations in their team. This is not how innovation happens.

But If we are keeping it 100, obsessed and experienced founders might not be enough. Our markets demand a hefty dose of sacrifice from founders. Without a safety net, leaving a steady paycheck is a gamble many can't afford particularly if you are the main breadwinner of the family. We need founders who have the financial resilience to withstand all the things Africa & entrepreneurship can throw at you.

We need founders who don’t need to ‘hire entrepreneurship’.

Just to be clear, Ngozi is not saying that if you don’t have savings you shouldn’t become a founder. Many of my (fre)nemies believe that I was born with a silver cutlery set in my mouth. Even to this day, some people ask in great confusion why I am perpetually fundraising; because clearly, I can go and pluck at will from the family money tree. If they knew that I have been downgraded to fly business class for over a decade since Pater cut my allowance, they wouldn’t make such inane comments. Idiots.

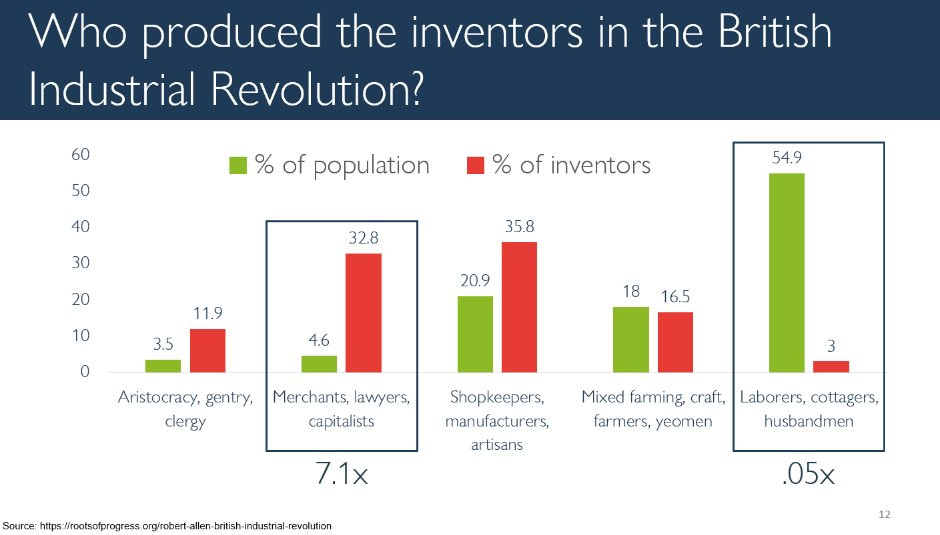

Seriously though it’s not about excluding those without stashed savings, but urging those with means to step into the ring. This may be a controversial take but there is empirical evidence. In studying important inventors of Britain’s Industrial Revolution “merchants, lawyers, and capitalists” made up only 4.6% of the population, but provided 32.8% of the inventors.”

This has been longer than I intended but my takeaway is that this may be the dawn of a new era. To be clear I am not expecting a decade of sugar and spice and all things nice; far from it. I do foresee (and pray for 🙏️️️️️️🙏️️️️️️) however, a period of meaningful innovation from gritty founders. I think I will be right because, given the current conditions, there is no alternative.

Great article, but we are not breaking the bank, overly we have attracted less than 1% of the global VC. Is it not a matter of you either learn or win for the ecosystem.

Really enjoyed reading this. A question I've frequently asked myself as I've followed the space closely over the years is, are some startups really going to 100x or truly be worth a billion dollars looking at the exisitng macro of their main operating environment? I'd like to read your views on defining or redefining "success" in the Nigerian (African) startup space. I understand it's not supposed to be easy but I wonder if this redifintion can inform better funding decisions eg Why 10m ARR target in 5 years? Why is revenue still reported in dollars? BTW, I understand the reasons but should we review these is the question? Should the metrics be VC-friendly only?

Really curious as to your view on these.