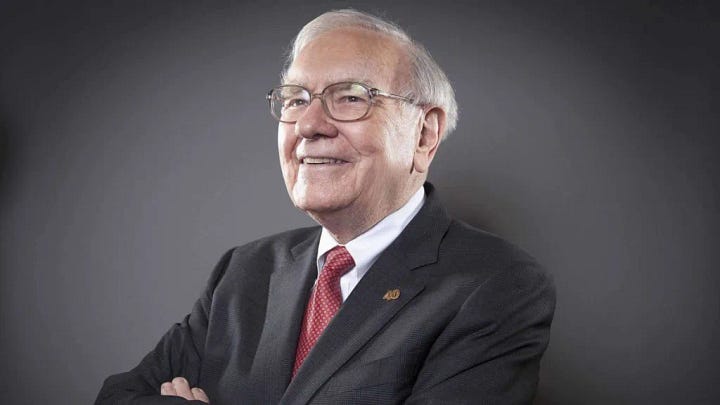

What happens if you put Warren Buffett & SBF in the same room? Easy - no deal!!

A call for a return to first principles

A few months ago, it came out that Sam Bankman-Fried (SBF), the founder of FTX was playing League of Legends whilst actually pitching an investment to Sequoia Capital, much to the amazement and wonder of the Sequoia team.

"We were incredibly impressed," Bailhe said. "It was one of those your-hair-is-blown-back type of meetings."

Now, imagine if this was Warren Buffett actually speaking to SBF. For starters it probably would not be a zoom call, since the seer of Omaha has a preference for in-person meetings. And we also know that there is no way in hell that Buffett was going to part with10 cents, talk less of the $214mm that Sequoia invested. Warren Buffett operates on fundamental principles, the first of which (check his shareholder letters, its always there) is:

Don’t invest in fools who ask for money whilst playing computer games.

We all know what happened with SBF & FTX. It sounds ridiculous that this pitch happened but we were in heady days and there was such a preponderance of bad behaviour that normal behaviour became the exception.

It takes us putting ourselves in the feet of the world's best investor to realize that fundamentals always matter irrespective of the season. Warren Buffett would not invest in somebody who did not have the courtesy and respect to focus on their conversation when playing a game. Whereas he might lose out on some deals if he went against his principles, he would ‘win’ most of the time. And it seems like he has done ok.

Back to School

It seems to me that there are a few first principles that have been forgotten over the last decade and it's now time to bring them back. Time for some of the clowns we see - both founders and investors- to go back to the school of fundamentals.

These, as you would expect, are not rocket science, but somehow they have become the exception in a world of zero rate interest rates and zero common sense.

Don’t be badly behaved. Nothing difficult - just don’t be silly and avoid hubris.

Celebrate real milestones, not fundraises

Founders eat when ALL investors eat

Customers pay for goods & services - not investors

Employees work at the convenience of the business, not the other way around

Let’s get into all five of them.

Don’t be silly

The first I've already talked about is hubris and just common courtesy amongst stakeholders, be they investors, employees or employers. We all play an infinite game but when the market is hot, everyone seems to forget that the economy is cyclical. Without that, s*** just goes to the fan. Enough said. Let’s move to the next four.

Celebrate real milestones

Its time to stop glorifying fundraises and instead celebrate real milestones. Let’s glory in what has been achieved rather than what is promised to come. I've talked previously about the enthralment of vanity metrics. Historically the only fundraise that was touted was that of an IPO or an initial public offering. This was where the company had done a lot of good work, embraced transparency, and then went out to the public market. The value quoted on an exchange was based on financials built using generally accepted accounting principles, and deemed to be the true and fair estimate of the company's valuation.

What we have right now is the opposite; we have valuations that are opaque, hidden, and not a reflection of what the company has done to build value; just how sexy the current trend is. Crypto, AI, Climate. The chase for the new new thing or the valuation pop when the next excited investor agrees to ridiculous secondaries (I am coming for this).

Going forward, we need to go back to celebrating fundraises when and only when it is about an IPO. A true coming of age where the founders and company have embraced transparency and no longer scared of the scrutiny of free markets. That is something to be celebrated; not the fact that Sequoia were impressed you hit the highest level of League of Legends whilst pitching your exchange.

Let's just shut up. Let's celebrate real things, maybe like profits; even expansion into new markets but real tangible progress. Otherwise just 🤫🤫🤫🤫🤫🤫

Eating together

Moving swiftly on, let’s talk about alignment between founders and investors. The good book has a profound saying:

“Thou shall eateth only after thine investors “

Founders should only eat well when others have eaten well. Historically, there was alignment again at the IPO stage, even for private equity, when there were real returns that everybody enjoyed. Now you have the scenario where new investors come in before the company is sustainable or has provided internally generated returns, and folks are “taking some chips off the table”

In the worst cases, said founder may set up a small fund, and become an advisor to other companies. If said company its spitting off cash, no harm no foul. Meanwhile though Mr Founder - and let's be fair it has only been men- has not even got his business up to a sustainable level. But its amazing that given the paucity of exits in our markets investors have allowed this to happen. (Any investors that Carbon is speaking to please disregard this statement).

Let customers pay for value

I can’t even believe I am saying this but maybe, just maybe, it should be the norm that customers pay for product and services they consume. Not fat investors in Silicon Valley, but customers making a very active choice to pay for value that they're getting. With the new religion of blitzscaling - growing at all costs to capture market share- popularised by Reed Hoffman (my brother you have a lot to answer for), we reached a stage where investors have seduced founders to almost ignore unit economics; to even laugh in the face of unit economics.

Many companies have been growing, not because they found product market fit, but because the incentives to customers are so ridiculous that any customer will feel stupid not to take up the offer. Customers are clever - they will take freebies until the next idiot company comes along with a better offer.

Let me take my sister OPay, ostensibly doing well - but are they? Seems they are everywhere, great distribution blah blah blah but you have to ask for the return on investment to date to do a more objective assessment of their accomplishments. They have raised approximately $670mm to date; a lot of that has been spent on helping Nigerians eat well per the advert above which clearly has huge developmental impact. N10 (less than 3 cents) is also a great customer acquisition cost unless your customers just eat courtesy of Sequoia China and continue using their favourite banking app.

Union Bank in Nigeria is worth N205bn or about $450mm/$270mm, depending on which interest rate you want to depress yourself with, and made N30bn in profit in 20022. Folks, I am a big believer in the disruptive power of neobanks but I would rather use that money to buy shares in Union Bank. And that my friends is saying something!!!

Back to basics folks: if your customers are not willing to pay for value you are providing, it's probably not the right customer, or it's the wrong product. It really is that simple.

Ok my hand is hurting, let’s end this with my bête noire; my favourite issue that the struggle with daily is around productivity in the work place. with is around workers.

Remote work - the experiment has failed

Something that's been the talk of the town and is controversial, but not to me, and increasingly not to the bright and best of our lords in Silicon Valley or even Main Street America is that the inevitable move to remote as the default is a sham.

Our historical elders found that the office was an amazing concept to coordinate work. It brings workers into a place where there are economies of scale in terms of infrastructure, and coordination is easy because everyone is around. Now, what has happened is that productivity tools like Slack (great!) & Teams (God forbid) have allowed the coordination and resources to be distributed across geographies.

What we haven't factored in is the fact that when you're in an office, it is easy to speak to someone in a very timely manner. That's what's been missing in remote and that's what needs to come back. Because, yes, you can use slack, et cetera, and it works, but that efficiency gain is no longer there if you are only responding to my message 3 hours later. This wouldn’t happen in the office - I’d walk over, and yes distract you, but would get my answer maybe immediately.

We need to get to a stage where, yes, it can be remote, but if it's remote, you are, online, contactable, and ready to work. Because otherwise the efficiency gained from saving commute time and getting happier works is not enjoyed by the business.

The End

In conclusion, it's time to go old school. Over time we've seen that many of the greats have gone back to learn from their foreparents. Let's not be arrogant and think that a new thing is what needs to be done. Peace out.

As a bonus for making it this far. enjoy one of the great old school artists, Sunny Bobo, from Eastern Nigeria. Thank me later.